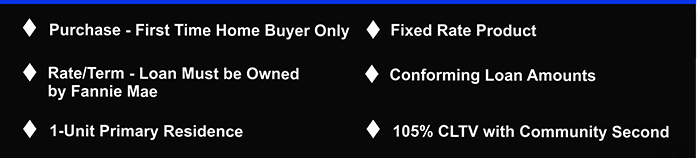

Purchase – First time home buyers only

At least one of the borrowers on the loan application (form 1003) must indicate they have not owned a home in the past three years. It’s nice they are not requiring both applicants to be FTB just one of them, this opens it up to a lot more people with 620+ credit scores and very low down payments.

Key question to ask: How much can the seller pay towards my closing costs?

Just because it’s only 3% down does not mean this is all you will need at closing. Make sure to find out before making an offer / signing a contract. You can normally ask the seller to contribute 3% of the purchase price towards closing costs and prepaid items, like the first years homeowners insurance.

Note: If you are comparing the Fannie Mae 97% to the FHA 96.5% Loan to value program note that FHA allows for 6% seller concessions which is more than enough to cover all costs and prepaids.

Rate and Term (no cash out refi) Refinance – loan must be owned by Fannie Mae.

We don’t need to talk about this much I don’t think many will be using this for a refi. It’s possible when HARP expires, but HARP is a better option.

One Unit Primary Residence

This is pretty clear you can only use this program to finance a one unit property you are going to live in or move into within 60 days of purchase.

Fixed Rate Product

This home loan program is only offered as a fixed rate. So no ARM options on this one which makes really good sense.

Conforming Loan Amounts

This means the maximum loan amount is the conforming limit for your area. In most areas that $417,000 for 2015.

| Units | Contiguous States, District of Columbia, and Puerto Rico | Alaska, Guam, Hawaii, and the U.S. Virgin Islands |

|---|---|---|

| 1 | $417,000 | $625,500 |

| 2 | $533,850 | $800,775 |

| 3 | $645,300 | $967,950 |

| 4 | $801,950 | $1,202,925 |

source: https://www.fanniemae.com/singlefamily/loan-limits

105% Ltv with Community 2nd Mortgage

If you are getting a 2nd mortgage grant from an eligible community organization the first and second mortgage amounts combined can be 105% of the purchase price.

In my opinion the two key benefits (pros) to this new in 2015 first time buyer home loan program over FHA 203b are 1). There is no upfront mortgage insurance (FHA is 1.75% financed on top) required and 2). The mortgage insurance premium can decrease and ultimately drop off after so many years worth of payments are made.

The FHA 203b pluses (FNMA Cons) are 1). you do not have to be a new home buyer all are welcome and 2). Credit guidelines and manual underwriting are much looser.

Please ask questions and let me know what you think in the comments section below or by calling the office at 813-874-5800. Share to me know you liked this article and to help others.